We’ve previously discussed how big data is being used to understand the behavioural characteristics of vessels and their impact on risk. The use of such data in pricing is profound, broadening the data lake that fuels Concirrus’ predictive modelling capabilities. Results such as risk score and expected loss are generated using behavioural insight, yielding a more accurate prediction through improved segmentation. The relative impact of each factor on any given risk score is displayed for transparency, allowing for a far more targeted approach to cover.

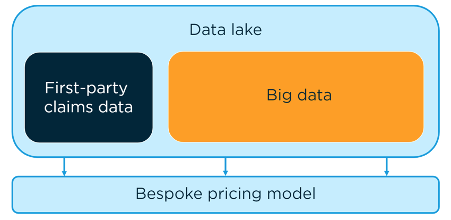

Predictive pricing typically requires the combination of big data with an insurer’s claims data, resulting in a bespoke model for each client. This approach serves large organisations very well, as they have the scale to hold a vast amount of data. The outcomes are continually measured and tested so that the accuracy of the model reflects the characteristics of the organisations specific data.

Fig 1: The implementation of first party data to draw insight

As more insurers utilise Concirrus’ modelling capabilities, the limitations for those who don’t have access to a vast data source come to light. In response, we have improved the accessibility of our predictive modelling technology so the entire market can benefit. To do so, we collaborated with leaders in the insurance industry, drawing on the learnings of prior models to create a market-wide view of risk. The result is the ‘Market Model.’

What do we mean by a market-wide view of risk?

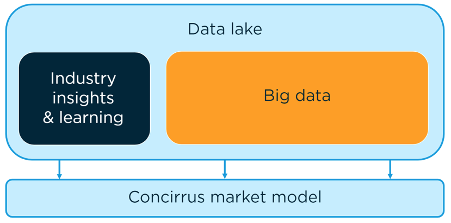

The market model accesses a data lake, as per bespoke models, but with a fundamental difference. Proprietary data that’s typically provided by an organisation and combined with big data to form the data lake, is replaced with insights and learnings from across the insurance industry. When unified, and combined with big data, a rich data lake that is reflective of the wider market is achieved. When algorithms are applied, they can utilise the data to predict a risk score that isn’t representative of an organisation’s view of risk, but the market itself.

Fig2: Graphic highlighting the implementation of collated learning over first party data

How is data protected?

Whilst Concirrus employ strict security measures, no identifiable data is held within the data lake of the market model, ensuring compliance.

Updates to the model

Risk scores derived using the Market Model are automatically updated every month. This ensures any changes to the influential factors of vessels in the global fleet are accounted for. When a major change occurs, our team of data scientists explore the validity of the change prior to its influence on the model.

In the case of a large anomaly, certain vessel types may display highly artificial variances in behaviour. These situations are reviewed and, if deemed to not reflect risk in applicable circumstances, are reverted to pre-artificial behaviour.

What it means for the market

The market now has access to a universal method of modelling risk that provides a risk score and expected loss based on behavioural insight. Both can be used to calculate new business premiums and audit the premium adequacy of existing policies. An in-depth understanding of what factors are having the most influence on risk score is presented, giving both Brokers and Underwriters the ability to mitigate their influence and incentivise improvements in risk profile over time. All the benefits of predictive modelling can be delivered to the market regardless of the quality of underlying organisational data, helping accelerate digital transformation efforts by removing a significant barrier to entry.

For more on pricing, read our white paper, or contact the team!

Powering the future of insurance

If you want to book a 1-1 meeting with us then let us know by clicking the link below.

Book a meeting